Expanding tourism is a policy priority across countries in the Middle East and North Africa (MENA) region. This is mainly due to governments seeking to diversify their domestic economies and create new employment opportunities.

Diversifying economies away from an overreliance on hydrocarbons is a key theme for the major hydrocarbon producers in the MENA region, notably within the Gulf Cooperation Council (GCC). Hydrocarbon exports account for more than 15% of total GDP across all the GCC members, with Kuwait, Qatar and Oman all above 30%. The global average economic dependency on hydrocarbon exports is 0.5%. Finding alternative, more stable avenues for economic growth is crucial amid volatile hydrocarbon prices.

While the economies of North Africa are less heavily exposed to hydrocarbons (except Libya), many countries in the region are also pursuing tourism as an essential sector for growth. A key underpinning factor is a desire to boost employment, particularly youth employment, and take advantage of their demographic dividends. A thriving tourism sector is a notable job creator across retail, hospitality and construction, and can help tackle chronic unemployment in the region, which also threatens social and political stability. Taking Morocco as an example, the unemployment rate for young individuals aged 15 to 24 is around 32%, which is almost three times the rate for the workforce as a whole.

Capitalising on greater demand for sustainable tourism

Sustainable tourism has become a buzzword in the global tourism space. In fact, according to Raki Phillips, Chief Executive Officer of the Ras Al Khaimah Tourism Development Authority, “the need for destinations and travel service providers to go green will be a defining trend for 2023, with sustainability a top priority for today’s travellers and consumers – both here in the GCC region and globally”. Sustainable tourism is defined by the UN Environment Program and UN World Tourism Organisation as ‘tourism that takes full account of its current and future economic, social and environmental impacts, addressing the needs of visitors, the industry, the environment and host communities’. Eco-tourism, although often placed in the same category as sustainable tourism, is primarily focused on the natural environment rather than incorporating social and governance factors.

Sustainable tourism has gained traction globally due to rising consumer demand and strengthening global sustainability policies. CB Ramkumar, Vice Chairman & Regional Director – South Asia at the Global Sustainable Tourism Council agrees: “traveller mindset shift, followed by demands that are being made by agencies like the UN, is driving a fundamental change in the way we do business”.

The number of ‘sustainably engaged’ tourists is increasing globally, and sustainability practices are increasingly impacting consumers’ decisions to visit a destination. According to Mr Phillips, “the ecotourism market globally was predicted to have grown to US$185.43 billion last year, driven by consumers who are becoming increasingly more mindful of sustainability and travelling in a responsible manner, where they look to positively impact the community and places they visit”. In fact, the latest ranking of the Travel & Tourism Development Index 2021 (TTDI) published in May 2022 by the World Economic Forum lists “Travel and Tourism Sustainability” as one of its key pillars for determining the attractiveness of tourism destinations. And looking more specifically at the MENA region, a study by the CSRE (Centre for Sustainability Through Research and Education) on the UAE tourism market concluded that sustainability had become the mainstream mindset rather than a trend related to a niche market.

More stringent corporate and sovereign ESG regulation is pressuring stakeholders in the tourism sector to implement their own ESG strategies and adopt sustainability agendas. For example, the UNGA sustainable tourism resolutions provide recommendations on ways and means to promote sustainable and resilient tourism development. Furthermore, and as highlighted by Mr Ramkumar, “global bodies like the UN are increasingly demanding that countries adhere to their NDC commitments…and this will put pressure on sectors like tourism to embrace sustainability”. Companies with transparent ESG strategies that can also demonstrate progress in addressing environmental and social issues are more likely to attract travellers.

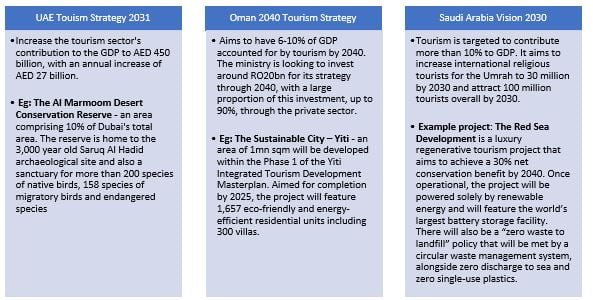

These factors have driven sustainable tourism growth in the MENA region, as countries capitalise on the rising demand for this type of tourism whilst also bolstering their individual sovereign-level ESG goals. The below graphic identifies some of the significant tourism agendas in the GCC region and highlights one of the critical sustainable tourism projects in each country.

GCC Sustainable Tourism Case Studies

UAE’s sustainable tourism agenda to accelerate in the run-up to COP28

The UAE government has taken several steps to enhance sustainable tourism in the country, and this will accelerate in the run-up to COP28, which will be held in Expo City Dubai

in November/December 2023. For example, it was announced in November 2022 that a new course has been launched to enhance sustainability in Dubai’s tourism sector ahead of COP28. The Dubai College of Tourism (DCT) and Dubai Sustainable Tourism (DST), both part of Dubai’s Department of Economy and Tourism (DET), have upgraded the ‘Dubai Sustainable Tourism’ course that is available on DCT’s innovative learning platform, Dubai Way. Embedding sustainability principles into all aspects of the tourism sector will be vital if the UAE is to meet its net zero targets by 2050 and promote itself as a global sustainability leader during COP28.

Divergent investment opportunities on offer

Growth in sustainable tourism sectors around the MENA region will fuel investment opportunities across the board in areas such as commercial construction, transport infrastructure, retail and hospitality. That said, the opportunities will differ from country to country, given the varying maturity of the sectors, visitor numbers and the divergent tourism strategies of the individual countries in the region.

In markets with well-developed tourism sectors, such as the UAE, Morocco and Egypt, investment opportunities will primarily centre on augmenting existing infrastructure to support the already elevated, and rising, visitor numbers. This includes improvements to transport systems, hotel construction and the development of additional leisure and entertainment facilities.

Meanwhile, in less mature tourism markets which receive more limited annual tourist numbers (for example Oman and Qatar received 3.5 and 2.1 million visitors in 2019, respectively, compared to 13 million, 7 million and 27 million in Egypt, Morocco and UAE, respectively), clusters of greenfield developments will likely be launched to expand the sector from the ground up. For example, in April 2022, the Oman government outlined six new tourism-related projects worth OMR974mn, including recreational parks, aqua parks and a zoo, with completion expected in 2026. Developing the associated transport and logistics infrastructure in conjunction with these developments will be crucial to facilitating a solid uptick in visitor numbers. Qatar, for example, transformed its transport sector in the run-up to the FIFA World Cup in 2022, including projects like the Doha Metro, expressways, electric buses and tram systems.

Saudi Arabia’s ambitious tourism strategy presents the most significant investment opportunities, particularly in sustainable tourism projects. Flagship projects such as NEOM, Qiddiya, Amaala and the Red Sea Project will require billions of dollars of investment and are multi-decade projects. However, significant challenges remain given the magnitude and cost of the development plans.