The development of civilian nuclear power has taken a prominent place on Saudi’s political agenda over recent years. The development of domestic nuclear sectors presents an increasingly attractive large-scale, low-carbon power supply option as it allows Saudi Arabia to meet elevated electricity consumption while also diversifying its energy mix.

Electricity demand and consumption in Saudi Arabia will remain high over the coming decade, underpinned by the expansion of cities, high demand for energy-intensive desalinated water production and generally low levels of energy efficiency. The latter point is in part due to electricity subsidies, which undermine the incentive for consumers to conserve electricity.

High demand for electricity is coupled with Saudi Arabia’s heavy reliance on hydrocarbons for power generation. Saudi Arabia’s electricity mix is almost entirely made up of gas (60%) and oil (40%). Diversifying this mix would enable Saudi to conserve hydrocarbons for export, and capitalise on the current higher oil price environment.

Nuclear aligns with Saudi’s net zero ambitions

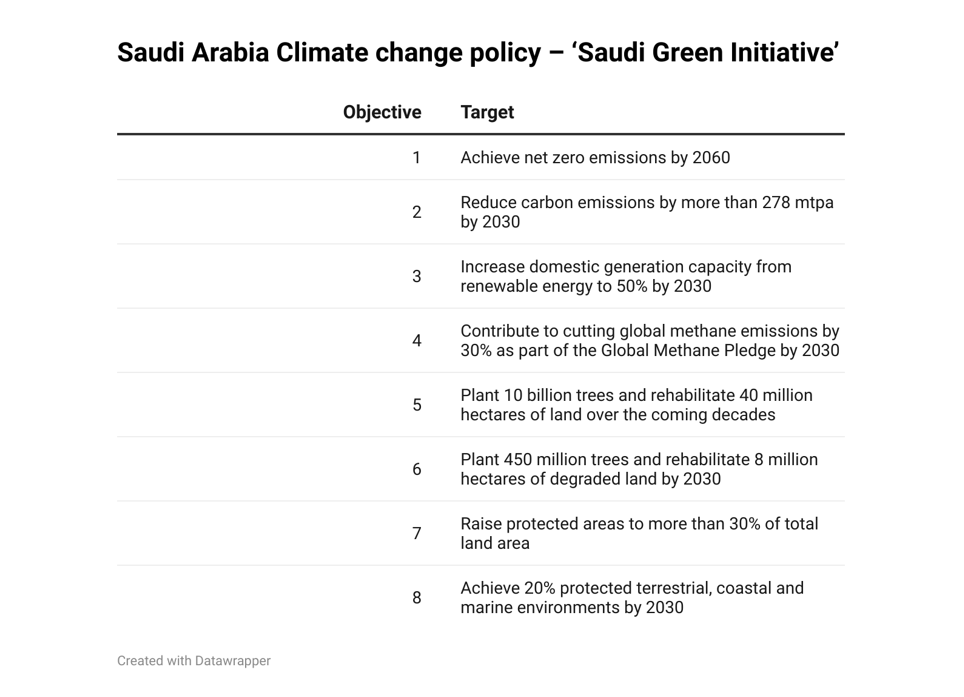

Reducing reliance on hydrocarbons and developing a low-carbon domestic energy source would also align with Saudi Arabia’s long-term climate change policies. Environmental sustainability forms a key component of the Kingdom’s ‘Vision 2030’. Specifically, ‘Saudi Green Initiative’ is a project which sits within the Vision 2030 and encompasses the country’s various decarbonisation targets (see below).

Saudi Arabia is looking to boost its reputation in the global climate change policy space, and pursuing sustainability as a driver of economic diversification will no doubt help this goal. Promoting itself as a major destination for sustainable tourism, developing flagship sustainability-orientated mega projects such as Neom and expanding the domestic low-carbon energy sector (via solar, nuclear and hydrogen) are all key initiatives under the Kingdom’s economic diversification agenda. That said, questions over the economic feasibility of such initiatives will remain, as well as accusations of ‘greenwashing’ given Saudi’s dominant role in the global hydrocarbons sector.

Nuclear agenda gathering momentum

Saudi Arabia originally set a target to develop nearly 18 GW of nuclear capacity by 2032; but that target was abandoned two years later. Despite this, the government remain keen to develop domestic nuclear power and momentum behind the sector has surged in recent months, as evidenced by the developments highlighted below. In fact, rising energy security concerns globally, in light of the Russia/Ukraine conflict and the surge in global energy prices, is encouraging several governments to accelerate nuclear programmes in order to diversify domestic energy mixes.

Recent developments in Saudi’s nuclear sector:

-It was announced in January 2023 by the Energy Minister Prince Abdulaziz bin Salman that “significant quantities” of uranium had been discovered in the Kingdom and the government intend to use it to fuel the development of its nuclear power industry.

-Also in January 2023, a Saudi-US partnership was agreed to develop low carbon energy. The partnership has identified several potential cooperation fields between the two countries in terms of civil nuclear energy and uranium.

-Russian nuclear company, Rosatom announced plans in December 2022 to bid for the construction of the first nuclear power plant in Saudi Arabia.

-The establishment of the Saudi Nuclear Energy Holding Company was announced in March 2022. The company has been set up to “develop, own and operate nuclear assets through affiliate or jointly established companies to produce electricity and desalination of saltwater.”

Several barriers facing a nuclear expansion

Despite the government’s continued support for nuclear power and gathering momentum in the sector, as highlighted above, there are still several barriers facing Saudi Arabia’s domestic nuclear expansion.

Capital constraints: Projects are extremely capital-intensive to build, while the cost of fuel, waste disposal and decommissioning means there are high long-run variable costs associated with nuclear generation. Nuclear power is also a relatively slow and complex process to build, often requiring several years or even decades from start to finish. This is in contrast to renewable energy sources such as wind and solar, which can be developed much more quickly and often at a lower cost.

Water security: Water scarcity is a major issue in Saudi Arabia, and the wider Gulf Cooperation Council (GCC) region and adding nuclear power generation to the energy mix could exacerbate this problem. Nuclear power plants require a significant amount of water for cooling and other purposes, which could put additional strain on Saudi’s already limited water resources. Furthermore, the high water demand from nuclear power generation could compete with other critical water uses, such as agriculture, industry and domestic use, potentially leading to further water stress in the region.

Stringent safetymeasures: Nuclear power remains a controversial energy source due to the potential dangers and risks associated with it.. The dangers of nuclear power are primarily related to the fact that nuclear power plants use radioactive materials, which can be extremely hazardous if released into the environment. Additionally, the storage of radioactive waste from nuclear power plants poses a significant long-term safety risk. Positive experiences with regards to nuclear safety regulation in neighbouring countries will help to offset some concerns within Saudi Arabia. For example, according to an International Atomic Energy Agency (IAEA) review, the operator of the Barakah nuclear power plant in the UAE has improved its operational safety by fully implementing the recommendations from an initial safety review mission conducted five years ago. The review, released in September 2022, highlights the operator’s commitment to ensuring the safety and security of the plant, and the strictest measures taken to address any potential risks.